PROFESSIONAL BUSINESS CONSULTING

Empowering Government Success with AI Consulting, R&D, and Integrated Solutions

AAIT Enterprises Corp is a minority-owned small business specializing in AI consulting, research & development, logistics, minor construction, and e-commerce services for government agencies. SAM Registered: UEI: RMC9GVY5GK45

(CAGE: 11Z94).

About Us

Empowering Your Business Journey

AAIT Enterprises Corp is a minority-owned small business specializing in Artificial Intelligence consulting, research & development, logistics, minor construction, and e-commerce services.

With over 10 years of experience and leadership backed by an MBA in Logistics, we deliver smart, scalable solutions that meet evolving government needs with full compliance and operational excellence.

✔ 10+ Years in Business

✔ Leadership Backed by MBA in Logistics & Advanced Supply Chain Expertise

✔ SAM Registered | UEI: RMC9GVY5GK45| CAGE: 11Z94

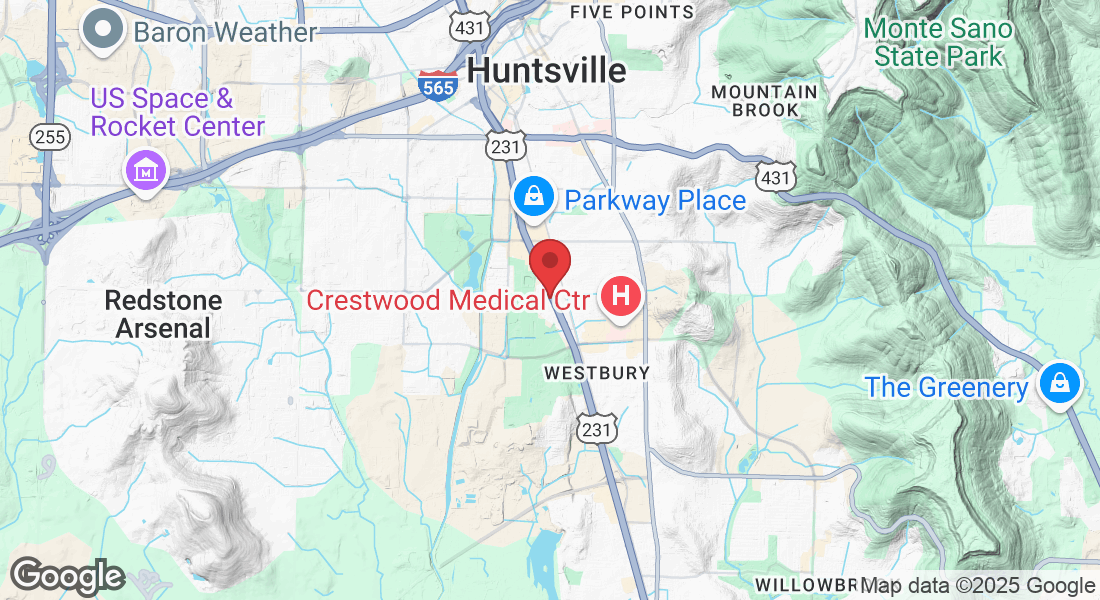

✔ Huntsville-Based (Prime Defense & Technology Hub)

Services

Our Core Capabilities

1️⃣ AI Consulting & Implementation

2️⃣ AI Research & Development

3️⃣ Logistics & Supply Chain

4️⃣ Minor Construction & Facility Support

5️⃣ E-Commerce Solutions

Why Chose Us?

✔ Minority-Owned Small Business (Set-Asides Eligible)

✔ AI-Focused Expertise

✔ Integrated Services: Consulting, R&D, Logistics, Facilities

✔ Proven Operational Experience (Est. 2013)

✔ Huntsville-Based – Defense & Tech Hub

Financial Management and Analysis

We provide comprehensive financial management and analysis services to help agencies and organizations maintain fiscal responsibility and achieve strategic goals. Our expertise includes budgeting, cost analysis, forecasting, risk assessment, and performance measurement. We deliver clear, data-driven insights to support informed decision-making, ensuring compliance with federal financial regulations and optimizing resource allocation.

Leadership and Team Development

AAIT Enterprises Corp is guided by a leadership team with deep expertise in consulting, logistics, and operational management. Our proven leadership ensures strategic oversight and precise execution on every project. Through established partnerships with subject matter experts and certified subcontractors, we expand our capacity to deliver specialized solutions across AI consulting, R&D, logistics, and infrastructure support.

Our commitment to mission-focused service and operational excellence ensures that every client receives reliable, results-driven support tailored to meet evolving government requirements.

TESTIMONIALS

CUSTOMER REVIEWS

★★★★★

“AAIT Enterprises delivered our project on time and with outstanding precision. Highly recommended for logistics and compliance work.”

– Jason / Building with Faith

★★★★★

“AAIT Enterprises provided outstanding service with a high level of professionalism and attention to detail. Their deep understanding of logistics and operational requirements made a measurable difference in our project’s success.”

– Operations Manager, Derrick

OUR TEAM

AAIT Enterprises Corp is led by an experienced management team with deep expertise in AI consulting, logistics, and operational management. We collaborate with a trusted network of certified professionals and subcontractors to deliver specialized services across AI R&D, compliance, logistics, and infrastructure projects.

Our team approach ensures that each project is staffed with subject matter experts and operational specialists, enabling us to meet complex requirements with precision, agility, and full compliance.

FAQS

What types of government contracts do you pursue?

We provide services under both federal and state/local government contracts, specializing in AI consulting, research & development, logistics, minor construction, and e-commerce support. We are eligible for small business set-asides and work as both a prime and subcontractor.

At [Your Company Name], our distinctiveness lies in our personalized approach to consultancy. Unlike one-size-fits-all solutions, we take the time to thoroughly understand your unique challenges, goals, and industry context. Our team of seasoned experts collaborates closely with you to craft tailored strategies and solutions. We measure our success by your success and remain committed to delivering results that align precisely with your needs and aspirations.

Are you a certified small business?

Yes, AAIT Enterprises Corp is a minority-owned small business, fully SAM registered with UEI: RMC9GVY5GK45 CAGE: 11Z94 We qualify for small business set-aside programs.

The timeline for seeing results can vary depending on the specific nature of your project and goals. While some improvements may be evident in the short term, sustainable and significant transformations often take a bit longer. Our commitment is to provide you with a realistic timeline during our initial consultation. Rest assured, we work diligently to ensure that you experience positive changes as efficiently as possible, while also focusing on long-term success.

What NAICS codes do you operate under?

Our primary NAICS codes include: 541611 – Admin & General Management Consulting 541715 – R&D in Physical, Engineering & Life Sciences 454110 – Electronic Shopping & Mail-Order Houses 484110 – General Freight Trucking, Local 238990 – All Other Specialty Trade Contractors

What makes AAIT Enterprises different from other contractors?

We combine over 10 years of operational experience with advanced expertise in AI and logistics, backed by leadership with an MBA in Logistics. Our integrated service model allows us to provide full-spectrum support—consulting, R&D, logistics, and infrastructure services—all under one roof.